Experts Maintain Zero Growth Expectation for Mexico’s GDP

Despite a more favorable tariff treatment from the U.S., economists at Banco Base and BNP Paribas maintain their zero growth projection for Mexico’s GDP in 2023.

Investments remain stagnant due to ongoing uncertainty, as negotiations or renegotiations of the US-Mexico-Canada Agreement (T-MEC) have yet to commence.

Both experts warn that there is still a risk of President Trump returning to protectionist rhetoric towards Mexico and Canada.

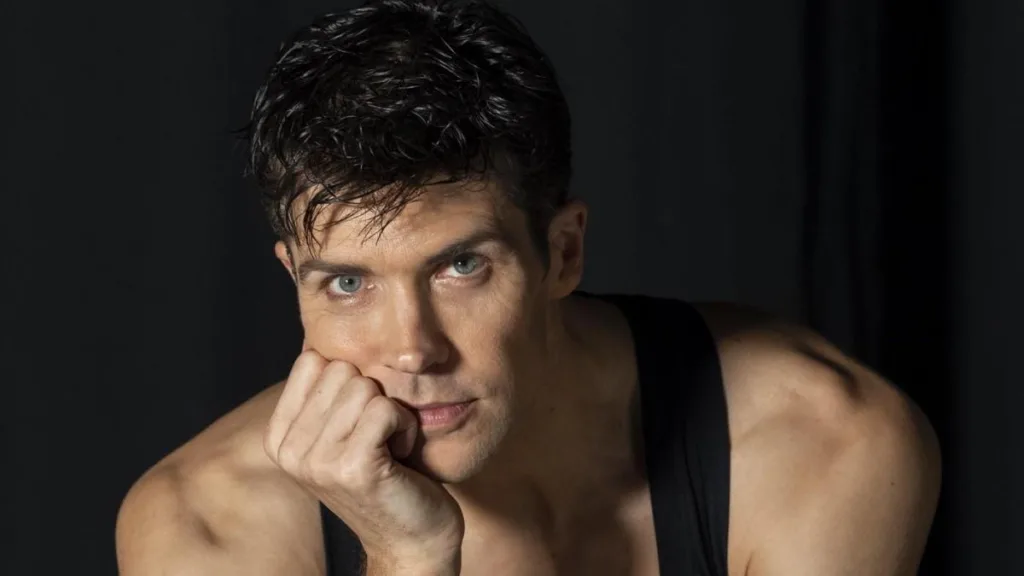

Gabriela Siller, the director of economic and financial analysis at Banco Base, highlights that 25% tariffs continue on goods outside the T-MEC, including 25% on steel and aluminum, and 25% on cars with exemptions for parts produced by any of the three agreement partners.

Siller explains that these tariffs apply to 51.2% of Mexico’s exports to the U.S., which are subject to the “most favored nation” clause under the World Trade Organization (WTO).

Market Opportunity for Mexico

Despite tariffs, Siller sees a market opportunity for Mexico due to T-MEC exemptions not available elsewhere.

However, she stresses that this potential depends on Mexico’s actions. “Under an optimistic scenario, Mexico could grow by 0.5%, but this would depend on how quickly companies can meet T-MEC criteria,” she explained.

Pamela Díaz Loubet, BNP Paribas’ economist for Mexico, emphasizes that no country benefits from trade restrictions and the current arrangement with the U.S., Mexico, and Canada is not advantageous for any nation.

BBVA Sees Nearshoring Advantages

Separately, BBVA believes that persistent tariffs on autos, steel, and aluminum violate the T-MEC and expects these to be reversed shortly.

With the U.S. imposing reciprocal tariffs on almost all imports but exempting Mexico and Canada, BBVA sees this as less protectionism against Mexico compared to other competitors, especially China, boosting nearshoring and potentially increasing integration between Mexico and the U.S. in the medium term.